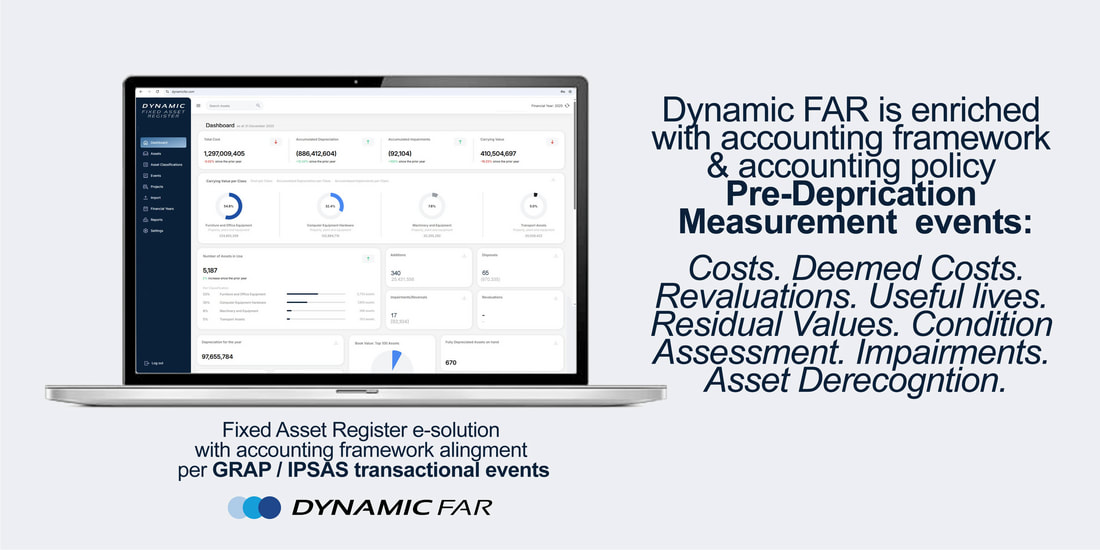

Fixed Asset Register e-solution with accounting framework alignment, accounting life-cycle automation and AFS reporting

Cloud-based Fixed Asset Register (FAR) which assists with asset accounting life-cycle automation & calculations, as well as GRAP / IPSAS Asset Reporting. It provides compliance with accounting framework's (GRAP / IPSAS) Asset Requirements & Aligned Data to entity's AFS reporting periods.

DynamicFAR = Structuring & Automation of Asset Accounting data in Asset Register

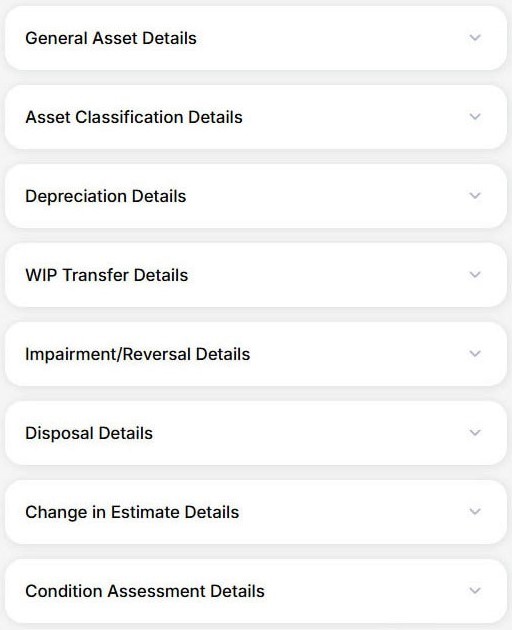

Dynamic FAR e-solution allows for the entities to capture, maintain and process asset information (i.e. general asset identification data and simplified asset accounting flows such as straight line depreciated assets), together with specific functionality to focus on practical Asset Accounting considerations impact FAR asset data, such as:

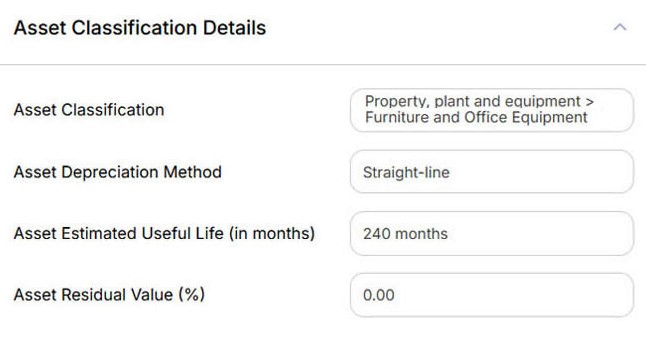

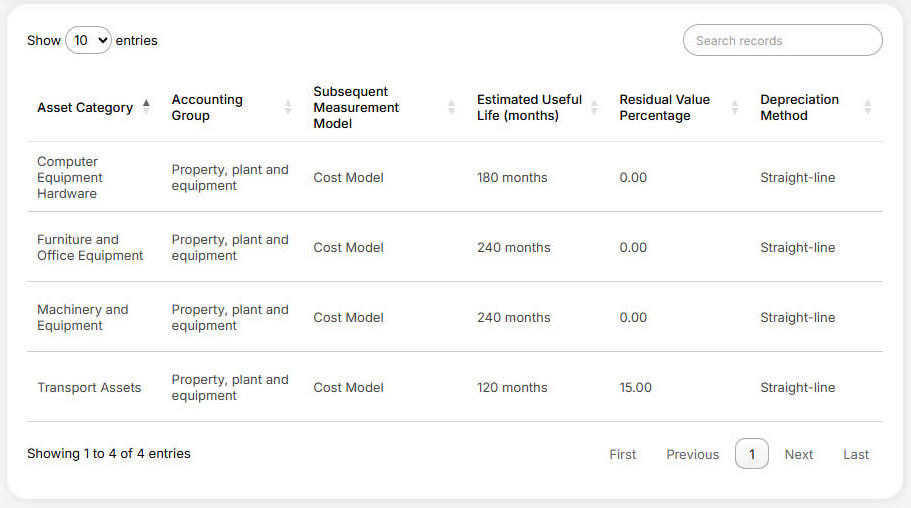

- Key accounting asset-base data required by the entity's Accounting Policies (Assets linked to Asset hierarchy levels, for management and statutory reporting)

- Technical Accounting Life-Cycle data elements linked to Accounting Reporting Frameworks (IPSAS / GRAP) (e.g. recognition / acquisitions, measurement (deemed costs, useful lives, residual value, etc) and de-recognitions within the Asset Register

- Technical Asset Measurement elements (provides for different asset pathways such as: Assets carried at Cost / Revaluation model; linked outputs impacting the AFS balances at individual reporting periods (annual depreciation, impairment, accumulated depreciation) and aligned depreciation methods per asset class (straight-line, diminishing balance and unit-of-production))

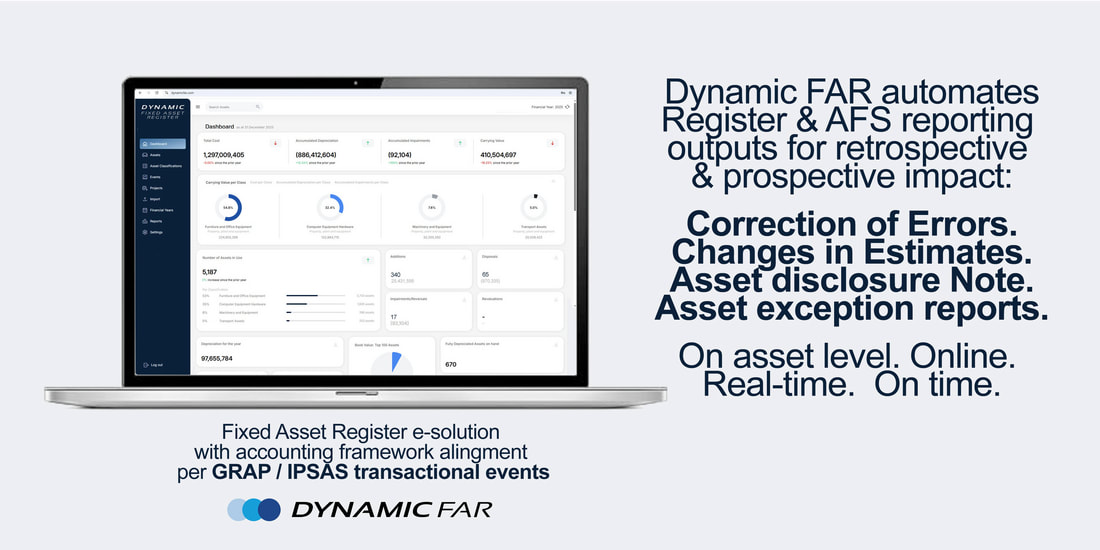

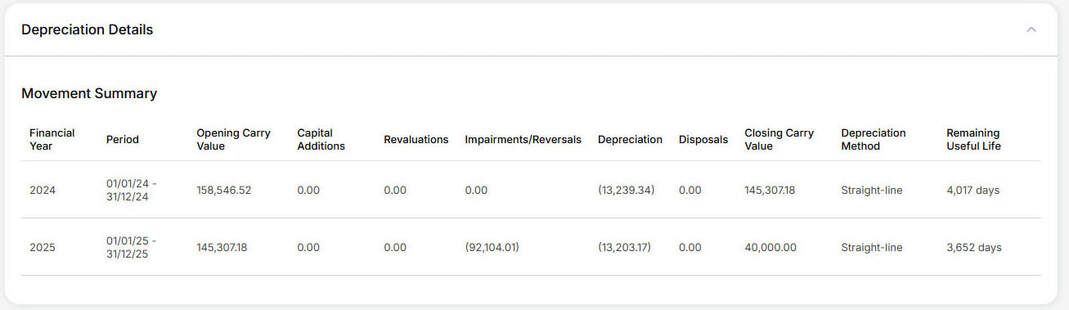

- Multi-period Asset AFS Disclosures. A continuous data line is run per asset life-cycle over multiple periods, allowing for current year asset adjustments to be correctly allocated in the prior period per asset within the Asset Register, but also provides data for AFS disclosures. This allows for reporting snapshots per reporting period based on such data adjustments (be it as prior period adjustments; correction of error; change in estimates) in the correct period, which impact subsequent measurement and other AFS disclosure elements.

- Automated Life-Cycle Reporting & Exception outputs, to provide data for retrospective / prior period adjustments on asset data and impact on values for different reporting periods used in a single set of AFS (current period (Y1), comparative period (Y0) and opening balance values (Y-1), or asset data exceptions (fully depreciated assets still in use / Assets carried as Zero Carry Value, assets nearing full useful life, impaired assets, etc).

- Integrates with DynamicVerify, for paperless asset verification which syncs asset verification and condition assessment results (for FAR impairment considerations).

Want to find out how to automate Asset life-cycle transaction reporting?

Book DemoImpact of Asset Register out-of-sync with accounting data?

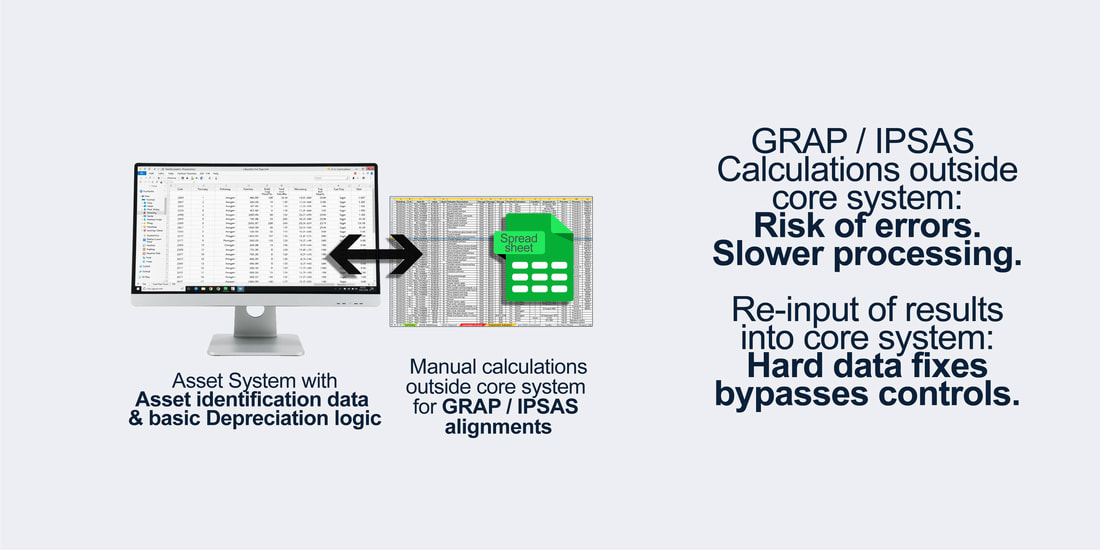

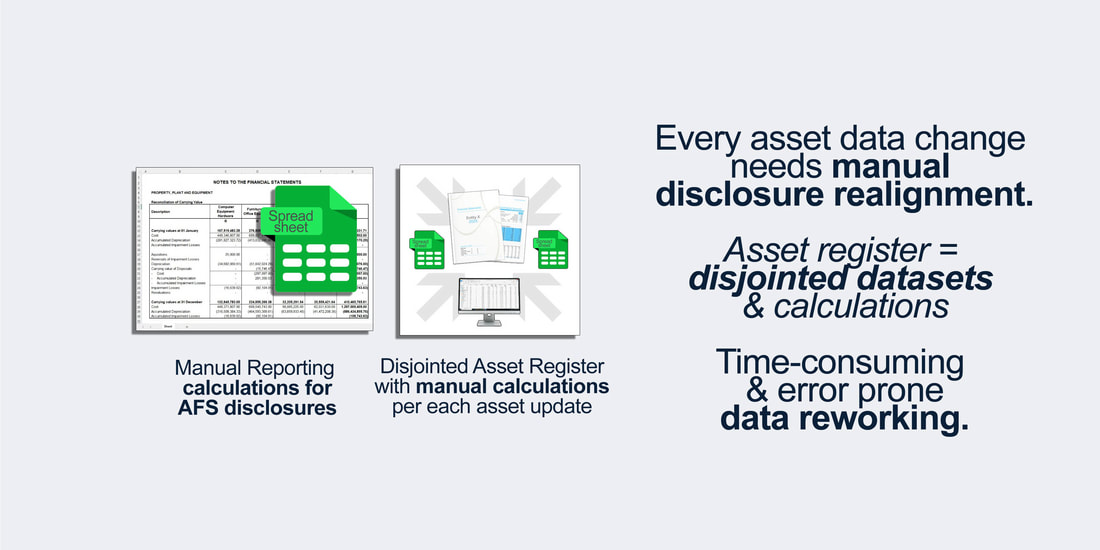

Entities place to much reliance on spreadsheets or fixed ERP systems to manage their asset accounting data, adding unnecessary complexities due to the structural and procedural limitations of disconnected data, which include:

- Time-consuming & Repetitive manual alignment of accounting data into fixed ERP Asset datasets risks data misalignments, data duplication or calculation errors, when ever any asset data line value changes

- Where asset registers are not kept in a fixed ERP Asset datasets, there is no data validation for inputs into the manual registers / spreadsheets introduce errors in data, calculations, data structures, etc. (e.g. #REF!, #DIV/0!, ###### errors).

- No change control on any inputs or consistency with calculations (missing formulas / data deletions / unauthorised asset data adjustments).

- Manual alignments also require further Manual asset reconciliations, only providing data accuracy at specific point in time (e.g. year-end), and not through-out the day-to-day management of the assets

- Complex retrospective adjustment of asset measurement data, with ERP roll-over of multiple periods. Time-consuming rebalancing and complex pivot-tables to be run to provide impact of changes for management / auditors.

- No automation of asset data for financial reporting & AFS complication requirements

DynamicFAR aligns Asset Register data with IPSAS/GRAP AFS Asset Transactional Event Automation & Reporting

The cloud-based DynamicFAR aims to assist entities to bring their asset accounting theory into practise, whereby the bespoke asset register e-solution seeks to address some of these key challenges faced by using spreadsheets / disconnected ERP systems for asset management and compliance reporting (GRAP / IPSAS): It assists entities to focus on the actual utilisation of their assets (i.e. to seek the flow of future economic benefits or service potential from such assets) rather than trying to manage compliance & accounting data. Benefits of the DynamicFAR system includes:

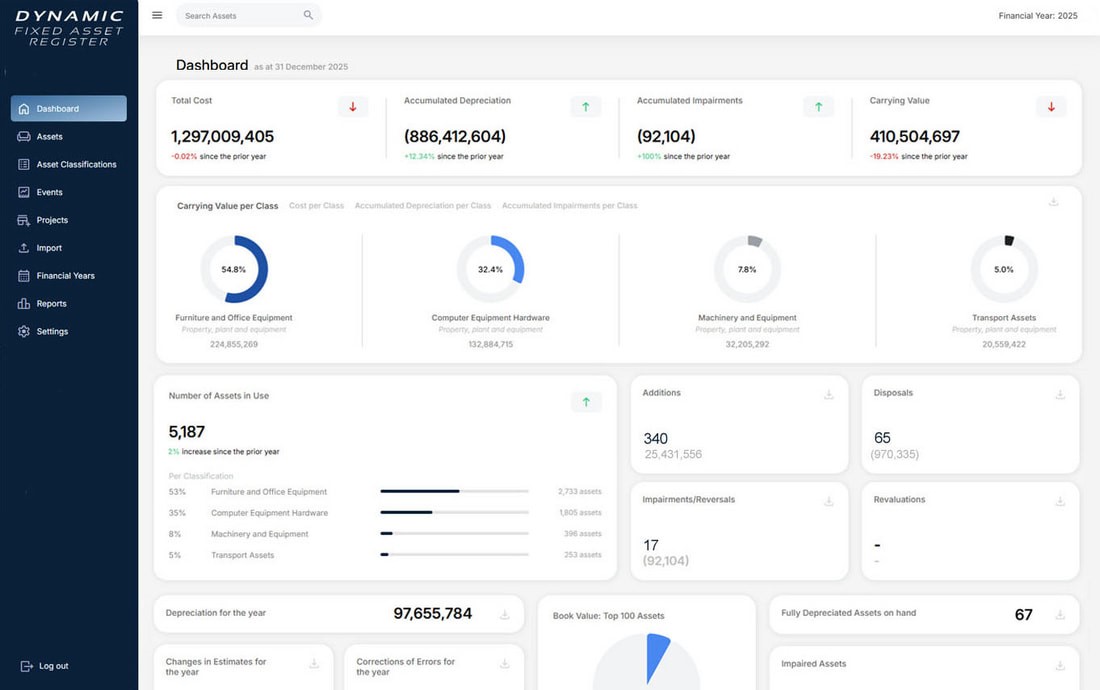

- Single source of truth of assets. Instant access to asset accounting data, visible on the tracking dashboard. Always up to date asset accounting data. Accounting history of asset transactional changes to support management & auditors.

- Automation of asset accounting elements and calculation (linked to set accounting policy & asset hierarchy) results in a reduction in time spent on asset accounting adjustments (e.g. correction or error adjustments on individual asset level, compounded over X years' back retrospective adjustments).

- Automatic data validation, Automated workflows & Pre-setup exception reports to manage data anomalies.

- Extensive asset accounting reporting outputs.

- The system requires no specialised or bespoke hardware, and allows for quick setup support once onboarded.

Key Asset Register information sets managed

Asset identification data

- Asset hierarchy data: accounting group > asset category > asset sub-category > asset group)

- Asset details & specifications (description considerations such as make, model, colour, material, asset number; barcode; serial number)

- Supporting documentation upload function

- Asset location details (longitude / latitude)

Accounting Framework (GRAP / IPSAS) data

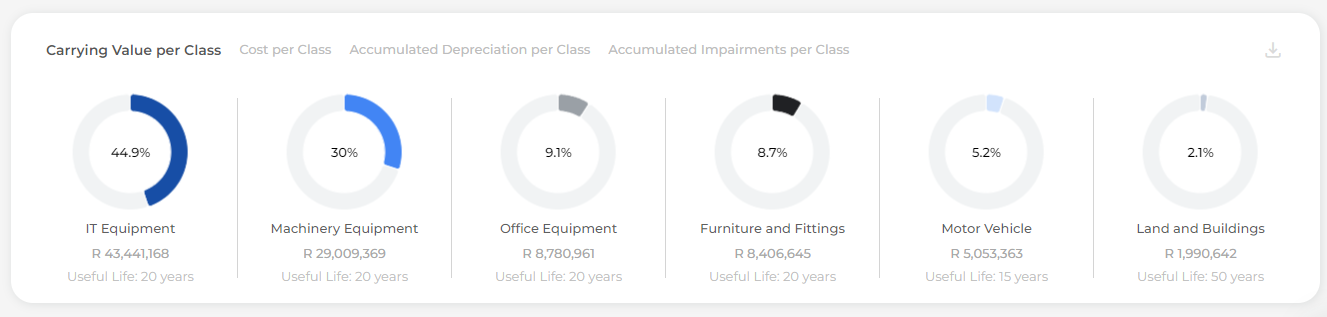

- Asset summaries and dashboard (values and asset classifications with snapshot details, Drill-down to individual asset level)

- Various depreciation methods (such as, straight-line and diminishing balance value)

- Assets acquisition date and availability status (e.g. in-use / ‘available for use’)

Asset Performance data

(which includes verified asset condition assessment data), impacting:

- Estimated Useful Lives (EULs)

- Remaining Useful Lives (RULs)

- Recoverable amount considerations

- Carrying Value of assets

- Asset impairments

System logic for accounting events impacting initial & subsequent measurement

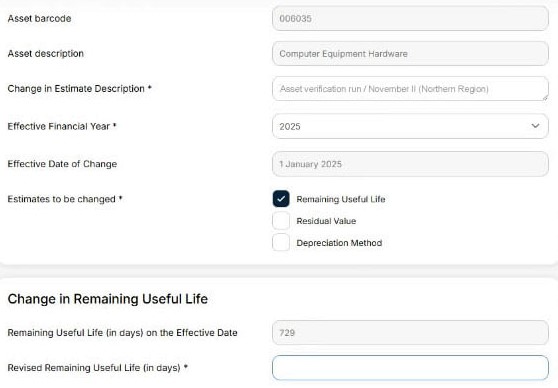

DynamicFAR data rules and logic allows for accounting events to be included in the base asset register, and flow-through in the measurement calculations. The inception data for asset classifications flow from the Accounting Policy (depreciation method) and Asset Hierarchy (classes), as well as management judgements (such as EUL , Residual Values, etc). DynamicFAR allows for subsequent events which impact the initial values and transactions, and is included in the system logic. This include for example Impairments, Changes in Useful lifes / Residual values, and other estimates, which then changes the Carry Values during the current / prior periods. These are all managed within the system. Below is an example of an impairment on individual asset level, impacting the measurement & reporting items such as current year depreciation, accumulated depreciation, accumulated impairment, carrying value, etc. The system also realigns the AFS outputs per the asset changes impacting the measurements. DynamicFAR provides for asset-level alignments, but also provides for summary outputs as required for reporting, where changes impacts are:

- Prospective: impacts current year depreciation and asset register elements (e.g. change in estimates for useful lives or residual values); and

- Retrospective: impacts prior year balances (aligned comparative depreciation values and accumulated depreciation, opening balances for the comparative periods, detailed summaries for value impacts per asset class per transaction type (e.g. correction of error / changes in accounting policies).

Line value summaries (e.g. impact of Impairment accounting event on depreciation)

Live Asset Register view & Reporting

Live view of asset accounting positions & policies

Given the system make provision for accounting events, DynamicFAR allows for real-time value assessment of the assets, where events managed. Once an asset is set per the allocated accounting policy and hierarchy, the systems can provide the outputs per its application.

Syncs with asset verification results

DynamicFAR also allows for syncing of condition assessment and asset data from the mobile asset verification system. This allows for interlinking of asset data as the verifications progress.

Work-in-progress

DynamicFAR also allows for WIP project data, flowing through initial stages of asset acquisition through to eventual capitalisation of the assets from where depreciation commences. Allows asset managers to manage asset data sets, asset locations (regions, buildings, room), personnel (asset verification team members & asset custodians) and verification outcomes.

Management & Exception reports

DynamicFAR has extensive management and exception reports available per the asset position and transactions. This include:

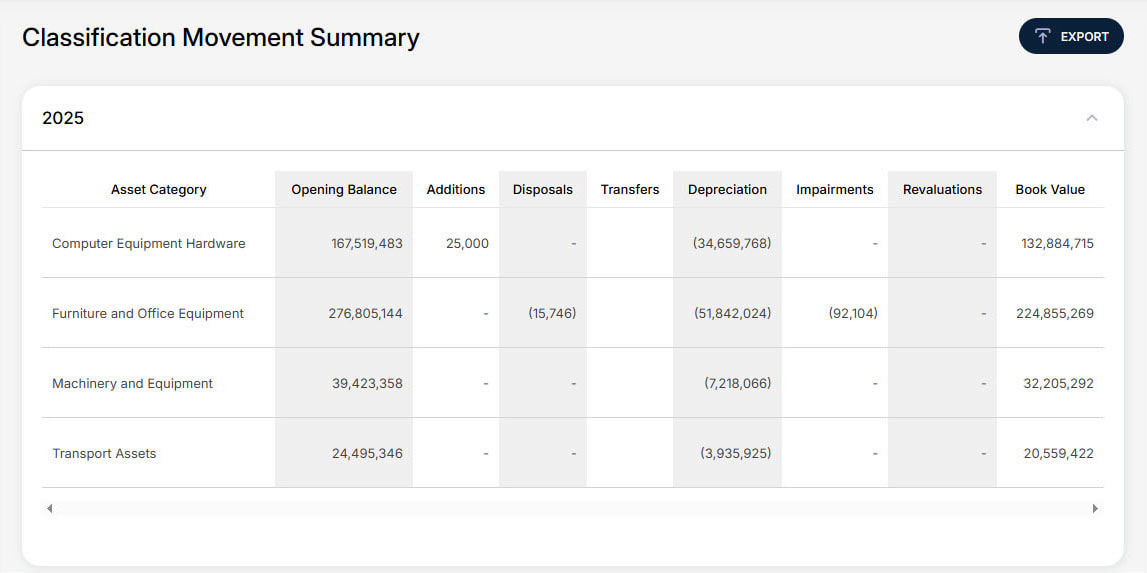

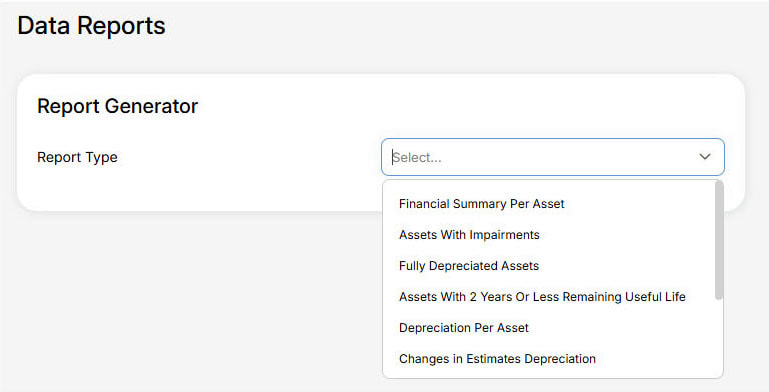

- Classification & Measurement reports (such as Financial Summary per Asset Classes, Movement Summary reports, depreciation reports, Assets with impairments, etc.)

- Exception reports (Fully depreciated Assets or Assets nearing Useful Life, etc.)

AFS Disclosure Note details automation

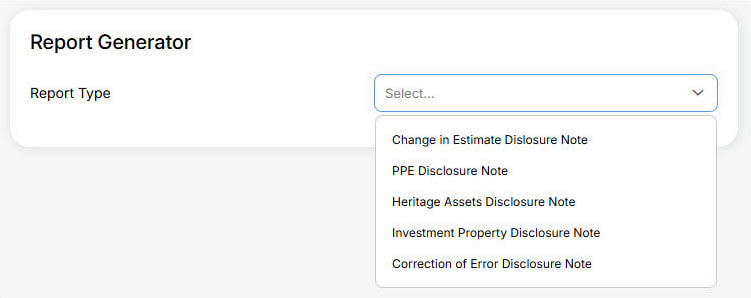

DynamicFAR also automates the transactional events and data for AFS Disclosures Note reports. This include:

- PPE Disclosure Note

- Change in Estimate Disclosure Note

- Correction of Error Disclosure Note

Want to request a virtual demo?

Book Demo